The Nilfgaardian floren has achieved more than most of us had in 1267. The currency has been on a bull run — for example, you can get 11 Temerian orens for 1 floren. If somebody offered you such a deal a year ago, you would decide they were mad. Wait a second – forgot what universe we were living in there for a minute – we aren’t even going to get to analyze Yen.

Well why don’t we take a look at the USD/PLN pair instead. The US dollar in 2022 has performed quite similarly to the Nilfgaardian floren — the currency has beaten the market. But the Polish zloty might change the ratio in the next year.

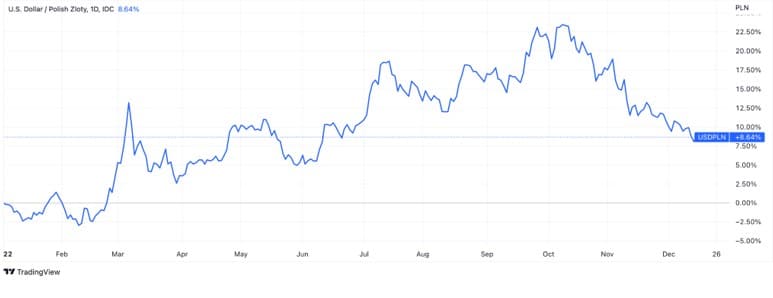

At the beginning of 2022, 1 USD was worth nearly 4 PLN — and during the year the cost hiked to 5 PLN. Then, by the end of the year, the zloty has improved the situation — the final result for the PLN is –8%.

The US dollar has been very strong not only against the zloty, but to other currencies too. In tough times, the USD acts as a safe haven for many people. Prices in stores are increasing, stock markets are falling and most world currencies are volatile. Therefore, the US dollar becomes not the worst and also an obvious option to save money.

Another reason for its recent safe-haven status is the fact that the American Federal Reserve hiked the key rate seven times in 2022. Every increase made the dollar more attractive and raised its rate. To monitor events such as the Fed’s meetings, use an economic calendar — it can help you to make extra profit.

Poland has experienced the same problems as the other countries in the European Union — namely the energy crisis and rising inflation. In Poland’s case, we shouldn’t forget its proximity to the military conflict between Russia and Ukraine — it creates additional and explainable tension. War events (including a missile landing in the territory of Poland) or even rumors about them, are able to affect the zloty.

The final reason is that Poland uses the zloty (not the euro) but is a member of the EU and is integrated into its economy. So, the events affecting the European Union countries and the euro affect Poland and the zloty as well.

The year has been a pretty unhappy one for Europe and its economy, but as we approach its end, the EUR and the PLN have come back half of their positions against the USD. It has happened because investors and analysts believe that the Fed will stop its hawkish policy in 2023.

Such a scenario is very likely, therefore we can expect that the USD will be decreasing to most currencies (including the zloty) in the second half of 2023. But the dollar may even remain strong enough in the first few months of the year to surpass others.

Additionally, investors may be drawn to emerging markets like those of Poland if global conditions become more predictable, stable, and less risky.

At the same time, the Polish economy with its low GDP growth, high unemployment and high inflation shows us that internal economic factors are unlikely to be drivers for an increase. As a result, the USD/PLN pair probably will be largely affected by external factors.

But before you make any trade, it’s very important to remember one thing. And that is doing your own analysis. Do this before buying or selling any assets.