Saving is a critical part of life that an individual must master. It’s even more important when making a significant purchase out of your regular income range.

A car, for instance, might require more than your current saving plan can afford. So, how to prepare for significant acquisitions?

There are four simple adjustments you can make to help you save money for major purchases.

They are: to find out the price and how long you will need to save, have a separate bank account, earn more, and cut costs.

These four principles can make much difference if you’re disciplined enough to follow them. It’s always wiser to plan for a significant investment and start saving on time.

However, you may opt for the best loan app Philippines offers for a quick bailout in emergencies. But you also need to be aware of high repayment rates, so using loans on an ongoing basis is not the best idea if you want to save up for important financial goals.

Keep reading to understand these four financial principles better.

Four Steps That Can Help You Meet Your Saving Target

When saving for a significant purchase, you must be direct with your strategy when saving for a substantial purchase. These four steps will help you to keep efficiently for your dream investment.

Find Out The Price And Save Accordingly

Before launching your plan, you must research the item you intend to purchase. Thanks to the internet, it is now easy to locate whatever you desire online.

For instance, if you want to buy a car, you could search with the query “cheapest car deals in Palawan.” When you find the price, you easily compare and contrast and set a limit you will stay within.

After identifying your target, you can work with an estimate. For instance, if the car you want is ₱1.2 million and you earn ₱50,000, if you save ₱30,000 a month for it, you will have to repeat this for around three years and four months to buy the vehicle. This part is crucial for more clarity on your goals.

Have a Separate Savings Account

One of the most significant setbacks to saving is your everyday expenditure. Differentiate your savings for major purchases by putting them in a separate account.

It is preferable if the account has a lock period to ensure you do not tamper with it. Also, the budget should be high-yield to gradually increase yield instead of getting deducted.

Leaving all your funds in your regular account is enough temptation to spend on unnecessary items.

Earn More – Consider Getting a Side Hustle

You might need more than banking on your regular source of income to make that purchase on time.

Price inflation will also mean that you have to delay gratification a little longer. Increasing your earning ability is a faster way to achieve your goals.

Your regular job might be demanding, but there are various side hustles you can engage in to increase your income.

The covid era has also helped to promote virtual freelancing jobs if that is your preference. You can easily take up jobs like being a virtual assistant or a remote graphic designer and earn a decent income.

To fast-track, your saving goals, add any proceeds from your extra jobs or side hustle there. You should also monitor your expenditures once extra income comes in to eliminate unnecessary spending.

You must be careful not to avoid taking on very tedious jobs to avoid reduced productivity. Find out what works best for you and create time to rest properly.

Cut Costs And Work With a Budget

Most people, by default, tend to spend more than they earn, which leads to debts. You should learn to cut costs and works with a budget. Numerous unnecessary expenses could be better for a proper saving plan.

For instance, you can choose to eat home-cooked meals rather than eat out in fancy restaurants. Also, unnecessary subscriptions should be canceled since it wastes essential resources.

Budgeting helps you work with a scale of preference and places your needs above your wants. You can plan your strategy for that significant purchase with a budget and get there quickly.

No matter how prudent you are, spending without a detailed plan will lead you to make some unnecessary expenditures.

Alternative: Consider Taking Loans

There are times when more than prudent financial behaviors would be required. Maybe you just spent on an emergency, or your targeted item has a time frame allotted to it.

You can use some of the best loan apps to complete your significant spending. Advances are okay if they are correctly managed and you have a repayment plan.

One benefit that loans offer users is the financial capability to make much-needed purchases. Sometimes, acquiring the item will motivate you to repay it before its due date.

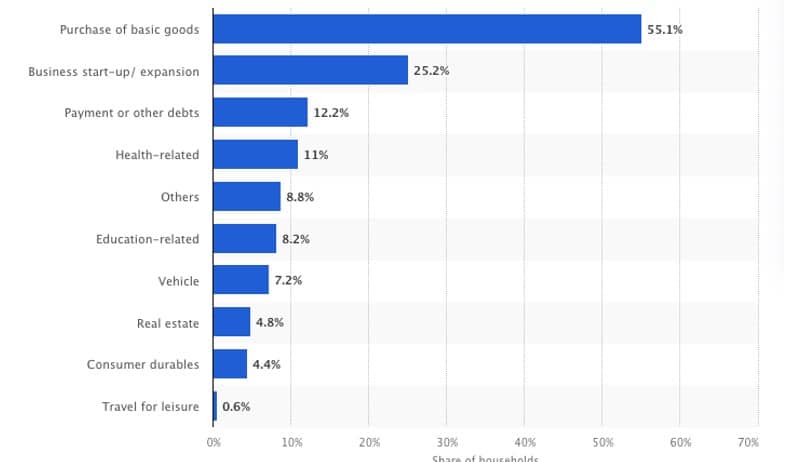

According to statistics, essential goods were some of the most popular purposes of advances among households in the Philippines during the 4th quarter of 2021.

Most popular purposes of loans among households in the Philippines during 4th quarter 2021

Link: https://www.statista.com/statistics/1267080/philippines-purposes-of-taking-out-loans/

This shows that loans are mostly taken to buy regular items needed for everyday use. In large areas like metro Manila, most of the population might have required these services at one point or another.

Benefits of Taking a Loan

A loan has several benefits users can take advantage of to make significant purchases.

Access to a Lumpsum

Saving sometimes could be frustrating, especially when your need is urgent. A loan can compound the money you need in one lump sum at a low-interest rate.

What would typically take you over a year to save can be within reach in a couple of minutes. The ability to attain your goals quickly is a great benefit of taking loans and makes it worth the effort.

Extended Repayment Times

Some loans give users options for flexible repayment tenures. This means you can develop a suitable repayment plan to stay within your financial capabilities.

Repaying ₱5000, for instance, over five months is much easier than a one-time payment.

Fast Disbursement Time

Digital loans generally are disbursed in a short time frame once you meet the criteria. Missing out on a potentially excellent or cheap deal on a major purchase due to a lack of funding should be avoided.

You may easily carry out your transactions on your mobile device.

Conclusion

Saving requires dedication and commitment to achieve your goals. Some steps you can take include: finding out how much you need to save and the item’s value.

You are separating your savings for significant purchases from others, earning more, cutting costs, and budgeting. These steps will help you achieve your goals eventually over some time.

However, sometimes you need to take advantage of a deal, and you might need more money.

A loan will help you make your acquisition and give you flexible repayment options. In the Philippines, reliable sources do not charge exorbitant interest rates.

Take advantage of such offers and complete your dream purchase quickly.